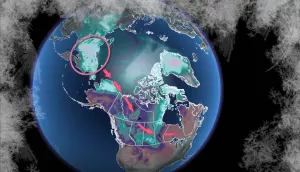

Jasper wildfire caused $880M in insured losses: Insurance Bureau of Canada

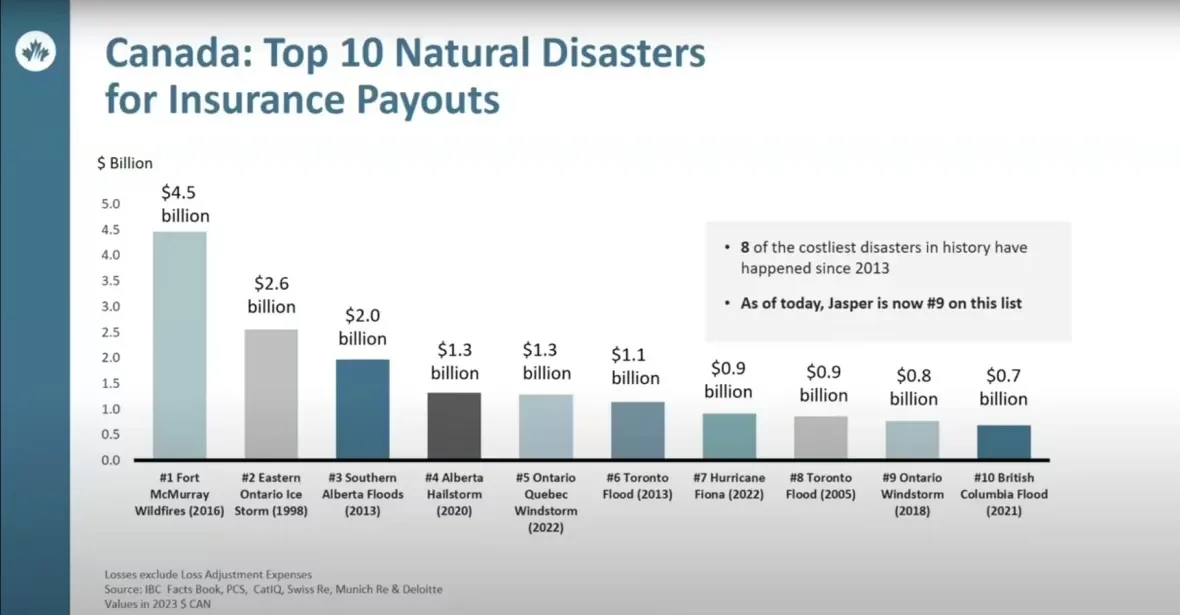

The wildfire that ripped through Jasper National Park this summer and destroyed a significant portion of the Jasper townsite is Canada's ninth most expensive disaster for insurance payouts, according to the Insurance Bureau of Canada.

The IBC estimates the insured damages — including homes, businesses, their contents and vehicles — to be $880 million. IBC says the wildfire is the costliest insurance event in Canada's national park history.

RELATED: Jasper used to burn often. Why did that change when it became a national park?

"Back in the 1980s, '90s and early 2000s, my industry was paying out on average annually hundreds of millions of dollars in severe weather," IBC national director Rob de Pruis told Jasper council on Tuesday.

"But over this past decade, that number is well over $2 billion."

He added while Jasper is ninth now, several other recent disasters — such as Montreal flooding, Ontario flooding or the Calgary hailstorm — could surpass it.

"But as of today, it's No. 9 and that is a big deal," said de Pruis, adding there have been about 2,500 claims from Jasper so far.

Fort McMurray remains the costliest natural disaster for insurance payouts at $4.5 billion. (Insurance Bureau of Canada)

A residential debris removal program is underway, including a sifting program done by Team Rubicon to help residents look for heirlooms among the ashes. According to de Pruis, more than 300 properties have signed up so far.

Once that process is completed, the goal is to clear all debris by Nov. 30 — with a priority given to commercial properties.

Coverage for air quality testing

Jasper Coun. Rico Damota said some residents are concerned about air contaminants.

"I read on social media about a family in Fort Mac that moved back into their home and then down the road six months later they found that there were contaminants within their home that caused them to be ill."

CANADA'S WILDFIRES: Visit The Weather Network's wildfire hub to keep up with the latest on the active start to wildfire season across Canada.

Damota said while he understood the air in a home can't be insured, Jasper residents are finding there's a discrepancy in what insurance companies will cover when it comes to contaminants.

(Liam Harrap/CBC)

It's a challenge because of a lack of standards for contamination levels — and insurance limits that may prevent people from being able to afford air quality testing, de Pruis said.

He added the first priority should be remediation and rebuilding.

"Some of this testing can be $20,000 to $25,000.… What's done with the insurance industry is they'll go in and do all the necessary cleaning to make sure that you have sufficient coverage to do all the necessary work," he said.

"And then if there still is coverage available, if you're still experiencing some problems, then you can use and utilize some of those testing processes to determine what type of contaminants are there."

He also warned residents should choose qualified remediation contractors to ensure that their property gets adequate cleaning.

WATCH: Wildfire a ‘potent’ way of releasing arsenic into the atmosphere, report says

Thumbnail courtesy of Connor O'Donovan/The Weather Network.

The story was originally written by Emily Williams and published for CBC News.